The Beginner's Guide to Passive Funds and ETFs: A Comprehensive Exploration

4.1 out of 5

| Language | : | English |

| File size | : | 5001 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 83 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

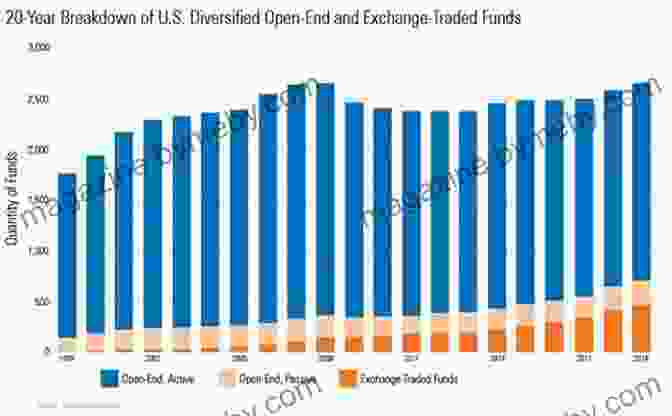

In today's rapidly evolving financial landscape, passive funds and exchange-traded funds (ETFs) have emerged as increasingly popular investment vehicles for both novice and experienced investors alike. These funds offer a range of benefits, including diversification, low costs, and potential for long-term growth.

This comprehensive beginner's guide will delve into the world of passive funds and ETFs, explaining their fundamental concepts, investment strategies, and the potential advantages they can bring to your portfolio. Whether you're just starting out in investing or seeking to enhance your financial knowledge, this guide will provide you with the insights you need to make informed decisions.

Chapter 1: Understanding Passive Funds

Passive funds are investment vehicles that track and replicate the performance of a specific market index or benchmark, such as the S&P 500 Index or the FTSE 100 Index. Unlike actively managed funds, which are managed by a fund manager who makes investment decisions based on their own research and analysis, passive funds follow a predetermined set of rules to track their target index.

The main advantage of passive funds is their low cost. Since they don't require the services of a fund manager, passive funds typically have lower expense ratios than actively managed funds. This can result in significant savings over the long term, especially for investors with large portfolios.

Chapter 2: Types of Passive Funds

There are two main types of passive funds: index funds and ETFs.

Index Funds: Index funds are mutual funds that track the performance of a specific market index. They are typically offered by investment companies such as Vanguard, Fidelity, and BlackRock.

ETFs: ETFs are exchange-traded funds that track the performance of a specific market index or basket of assets. Unlike index funds, ETFs are traded on stock exchanges, which gives investors the flexibility to buy and sell them throughout the trading day.

Chapter 3: Benefits of Investing in Passive Funds

Investing in passive funds offers a range of potential benefits, including:

- Diversification: Passive funds provide instant diversification by investing in a broad range of assets, reducing your exposure to any single company or sector.

- Low Costs: Passive funds typically have lower expense ratios than actively managed funds, which can result in significant savings over the long term.

- Tax Efficiency: Passive funds tend to be more tax-efficient than actively managed funds, as they generate fewer capital gains distributions.

- Long-Term Growth Potential: Passive funds that track broad market indices, such as the S&P 500 Index, have the potential to generate long-term growth by capturing the overall trend of the stock market.

Chapter 4: Investing in ETFs

ETFs are a popular choice for investors looking for a low-cost and flexible way to invest in passive funds. ETFs can be bought and sold throughout the trading day, just like stocks. They also offer a range of investment options, including:

- Broad Market ETFs: These ETFs track the performance of a broad market index, such as the S&P 500 Index or the FTSE 100 Index.

- Sector ETFs: These ETFs track the performance of a specific sector, such as technology, healthcare, or energy.

- Thematic ETFs: These ETFs track the performance of a specific theme, such as clean energy, artificial intelligence, or robotics.

- Fixed Income ETFs: These ETFs track the performance of fixed income securities, such as bonds or high-yield bonds.

Chapter 5: Choosing the Right Passive Fund

When choosing a passive fund, there are several factors to consider:

- Investment Objective: Consider your investment objectives and risk tolerance when selecting a passive fund. If you are investing for long-term growth, a broad market ETF may be a good choice.

- Expense Ratio: The expense ratio is a key factor to consider, as it can impact your returns over time. Choose passive funds with low expense ratios to minimize the impact of fees on your investment.

- Tracking Error: Tracking error is a measure of how closely a passive fund tracks its target index. Choose passive funds with low tracking error to ensure that your investment is closely aligned with the underlying benchmark.

- Liquidity: If you need to access your investment quickly, consider the liquidity of the passive fund. ETFs are more liquid than index funds, as they can be bought and sold throughout the trading day.

Chapter 6:

Passive funds and ETFs offer a range of benefits to investors, including diversification, low costs, tax efficiency, and long-term growth potential. By understanding the different types of passive funds and ETFs, and carefully considering your investment objectives, you can make informed decisions to create a well-diversified and cost-effective portfolio.

Remember, investing involves risk, and the value of your investments can go up or down. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

4.1 out of 5

| Language | : | English |

| File size | : | 5001 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 83 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Russell Zimmerman

Russell Zimmerman Journalist Leigh Gallagher

Journalist Leigh Gallagher Robert Marshall

Robert Marshall Wei Yang Chao

Wei Yang Chao Jonah Mcdonald

Jonah Mcdonald Tony Rafael

Tony Rafael Michael Herr

Michael Herr Jon Miller

Jon Miller Lois Mcmaster Bujold

Lois Mcmaster Bujold Joyce Hicks

Joyce Hicks John Schofield

John Schofield Jon Peterson

Jon Peterson Jonathan Nicholas

Jonathan Nicholas Julian Bell

Julian Bell W Robert Beckman

W Robert Beckman Joseph Harkreader

Joseph Harkreader Juan Mata

Juan Mata Jonathon Miller Weisberger

Jonathon Miller Weisberger Julie M Hauer

Julie M Hauer M C Goldrick

M C Goldrick

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Esteban CoxDiscover the Extraordinary Lives of Abd Al Rahman Amr Al Awza: The Architects...

Esteban CoxDiscover the Extraordinary Lives of Abd Al Rahman Amr Al Awza: The Architects...

Frank ButlerUnveil the Enigmatic Secrets of Mars in "The Fossil Science Fiction Thriller"

Frank ButlerUnveil the Enigmatic Secrets of Mars in "The Fossil Science Fiction Thriller" Albert ReedFollow ·16.3k

Albert ReedFollow ·16.3k Anthony BurgessFollow ·3.9k

Anthony BurgessFollow ·3.9k Hugh BellFollow ·8.7k

Hugh BellFollow ·8.7k Pete BlairFollow ·4.3k

Pete BlairFollow ·4.3k Levi PowellFollow ·4.3k

Levi PowellFollow ·4.3k Gordon CoxFollow ·17.6k

Gordon CoxFollow ·17.6k Felipe BlairFollow ·15.5k

Felipe BlairFollow ·15.5k Dwayne MitchellFollow ·5.8k

Dwayne MitchellFollow ·5.8k

Efrain Powell

Efrain PowellCritical Thinker's Guide to Media Bias and Political...

In a world awash with information, it has...

Aubrey Blair

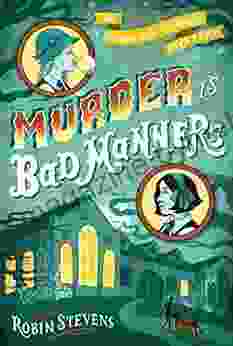

Aubrey BlairMurder Is Bad Manners: An Unforgettable English Mystery

Prepare yourself for a captivating literary...

Luke Blair

Luke BlairDon't Settle For Safe: Embrace Adventure and Live a Life...

<p>In this inspiring and...

W.H. Auden

W.H. AudenRoblox Codes Dragon Adventures King Legacy All Combat...

Roblox is a massively popular online game...

4.1 out of 5

| Language | : | English |

| File size | : | 5001 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 83 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |