As a business owner, accessing growth capital can be a daunting task. Traditional financing options often have strict requirements and limitations, hindering your ability to scale your operations effectively. However, there is a world of untapped funding opportunities waiting to be explored – institutional money.

Institutional investors, such as pension funds, endowments, and insurance companies, hold trillions of dollars in assets and are actively seeking opportunities to invest in high-growth businesses. By understanding the ins and outs of institutional money deals, you can position your business to attract these valuable investors and unlock the funding you need to accelerate your growth.

4.4 out of 5

| Language | : | English |

| File size | : | 3622 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 144 pages |

| Lending | : | Enabled |

Chapter 1: Preparing Your Business for Institutional Investment

Before you approach institutional investors, it is essential to prepare your business to meet their rigorous standards. This chapter provides a comprehensive guide to:

- Developing a solid business plan that outlines your growth strategy, target market, and financial projections.

- Building a strong management team with proven experience and industry expertise.

- Establishing a track record of profitability and sustainable cash flow.

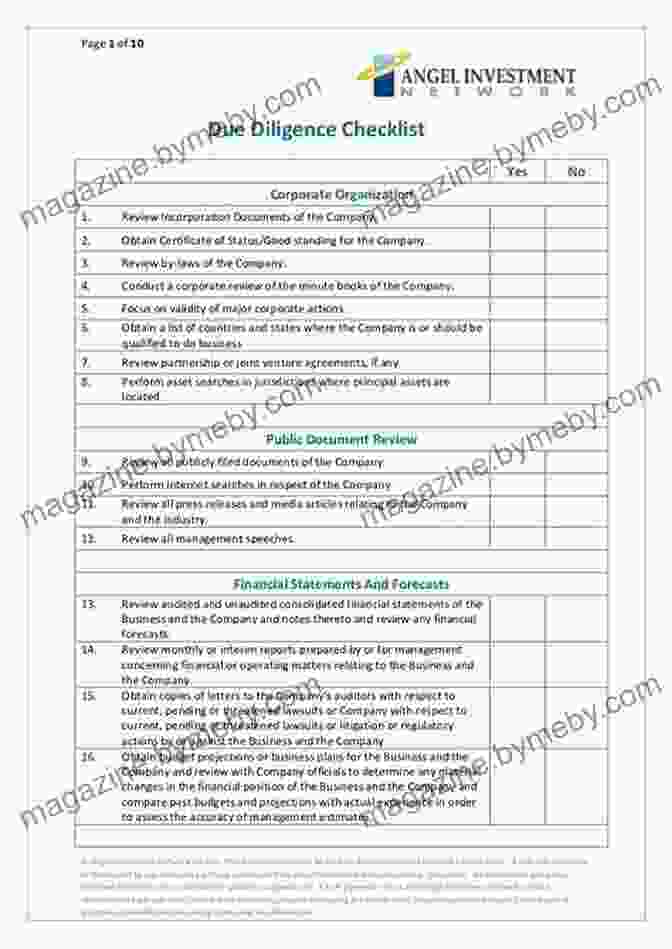

- Conducting thorough due diligence to identify potential risks and mitigate concerns.

Chapter 2: Understanding the Institutional Money Landscape

Institutional investors come in various forms, each with unique investment criteria and preferences. This chapter delves into the different types of institutional investors, including:

- Pension funds: Retirement savings plans for employees in specific industries or companies.

- Endowments: Permanent funds established by universities, hospitals, and nonprofits.

- Insurance companies: Entities that provide financial protection against risks.

- Family offices: Private investment firms that manage wealth for wealthy families.

| Type | Investment Criteria | Typical Investment Size | Time Horizon |

|---|---|---|---|

| Pension Funds | Stable returns, low risk appetite | $10 million to $100 million | Long-term (10+ years) |

| Endowments | Growth-oriented, impact investing | $5 million to $50 million | Medium-term (5-10 years) |

| Insurance Companies | Income-generating, long-term returns | $20 million to $500 million | Very long-term (15+ years) |

| Family Offices | Diversified, opportunistic | $1 million to $20 million | Flexible (short-term to long-term) |

Chapter 3: The Pitch and Negotiation Process

Once you have identified potential institutional investors, it is time to prepare and deliver a compelling pitch. This chapter covers:

- Crafting a persuasive investment deck that highlights your business's strengths and growth potential.

- Developing a clear investment thesis that explains how your business aligns with the investor's goals.

- Negotiating key deal terms, such as equity stake, valuation, and investment structure.

Chapter 4: Post-Deal Integration and Value Creation

Closing an institutional money deal is just the beginning of a long-term partnership. This chapter discusses:

- Integrating the investor into your business and ensuring smooth communication.

- Implementing a value creation plan that focuses on revenue growth, cost reduction, and operational efficiency.

- Maintaining transparency and aligning incentives to foster a mutually beneficial relationship.

Accessing institutional money is a transformative opportunity for bisnis owners seeking to scale their operations and achieve sustainable growth. By following the principles outlined in this guide, you can prepare your business, understand the institutional money landscape, pitch effectively, and create a successful partnership that will drive your business to new heights.

Unlock the power of institutional money today and embark on the path to exponential business success.